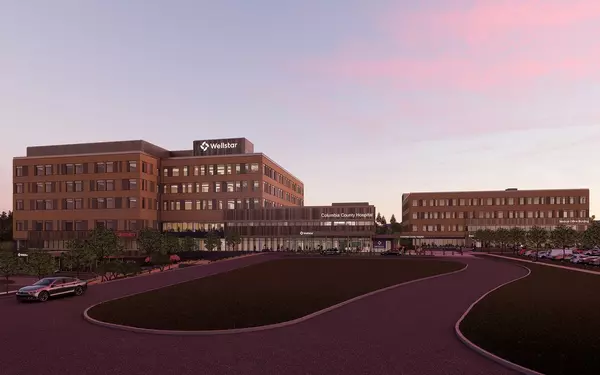

Columbia County’s First Hospital Is Taking Shape In Grovetown: Here's What’s Coming

If you live in Grovetown, Evans, or anywhere in Columbia County, you know the late-night ER calculus too well: do we white-knuckle it across the county line, or keep refreshing the “estimated wait time” that never seems to estimate correctly? That routine is finally getting an upgrade. The Wellstar

Read More

Nordhavn-Rustik Is Coming To Evans: What We Know

I love a new-restaurant announcement as much as the next foodie, but I get even more excited when a concept actually fills a gap in the market instead of just copying whatever is hot in Atlanta. That’s what Nordhavn-Rustik looks like for Evans. Picture a Scandinavian-influenced fine dining room on o

Read More

Columbia County’s Proposed “Data Center (D-C)” Zoning District: What Just Happened, What’s In It, and What It Means Next

If you’ve been following my videos on TikTok you’ve seen me hit this topic hard: Columbia County is moving to create a dedicated Data Center (D-C) zoning district. This is one of those “boring on the surface, huge in impact” stories. It’s not a single project approval. It’s the rulebook that would c

Read More

- 1

- 2

- 3

Categories

Recent Posts